Introduction

Many people worry about their money losing value over time. This common concern often relates to a powerful economic force: inflation. Understanding inflation is crucial for everyone. It affects your daily spending and long-term financial health. When prices rise, your hard-earned savings buy less. This erosion of purchasing power can be subtle. Yet, its impact on your financial future is significant. This article will explore what inflation truly means. We will also examine how it directly influences your savings. Learning about this concept is vital for informed financial decisions. Protecting your wealth requires a clear understanding of these dynamics. Let’s delve into this essential economic topic. Prepare to discover how to safeguard your financial well-being.

Decoding Inflation: The Basics

Inflation refers to the general increase in prices. It means that, over time, a unit of currency buys fewer goods and services. This phenomenon reduces the purchasing power of money. Imagine a loaf of bread costing $2 today. In ten years, it might cost $3. This increase is a direct result of inflation. Governments measure inflation using various indices. The Consumer Price Index (CPI) is a common one. CPI tracks the average change in prices paid by urban consumers. It covers a broad basket of consumer goods and services. Understanding CPI helps gauge the rate of inflation. A low, stable inflation rate is generally healthy for an economy. It indicates economic growth. However, high or unpredictable inflation can be very disruptive.

Economists categorize inflation into different types. Demand-pull inflation occurs when demand outstrips supply. Too much money chases too few goods. Cost-push inflation happens when production costs increase. This might be due to rising wages or raw material prices. Built-in inflation occurs when people expect prices to rise. This expectation leads to demands for higher wages. Businesses then raise prices to cover these costs. These cycles can become self-fulfilling. Each type has unique drivers and implications. Knowing these distinctions offers a deeper understanding. It helps us interpret economic news. This knowledge is key for financial planning.

The Silent Thief: How Inflation Erodes Your Savings

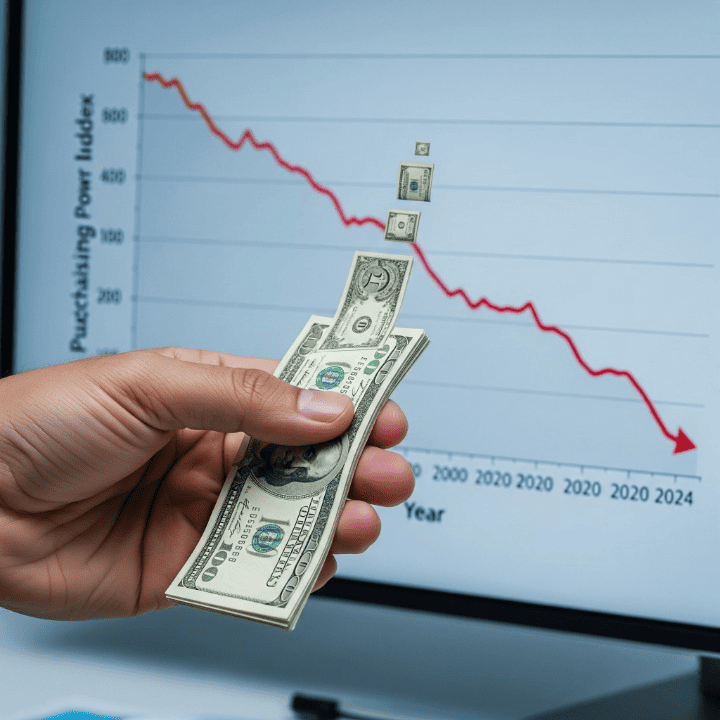

Inflation is often called a “silent thief.” It quietly diminishes the value of your money. If your money sits in a regular savings account, its value might decrease. Savings accounts typically offer low-interest rates. These rates often do not keep pace with inflation. For example, if inflation is 3% and your account yields 1%, you lose 2% of purchasing power. This loss occurs every single year. Over decades, this erosion can be substantial. Your future self will have less buying power. This is true even if the numerical value of your savings grows. This illustrates how inflation impacts your savings.

This effect is particularly concerning for long-term goals. Consider retirement planning. Many people save for decades to fund their retirement. If inflation averages 3% annually, prices double roughly every 23 years. This means your future retirement income needs to be much higher. It needs to afford the same lifestyle. Neglecting inflation can lead to a significant shortfall. It can impact your golden years negatively. This makes inflation a critical factor in financial planning. Protecting your savings from this “thief” is essential. Strategies exist to combat this silent erosion. We will explore these strategies next.

Inflation impacts various types of savings differently.

- Cash holdings: Cash suffers the most. Its value decreases directly with inflation.

- Low-interest savings accounts: These accounts barely keep up. They often lag behind inflation rates.

- Fixed-income investments: Bonds with fixed interest can also lose value. This happens if inflation rises unexpectedly.

- Long-term investments: Stocks and real estate can offer better protection. They often grow faster than inflation.

Understanding these differences is crucial for investors. It helps in making informed decisions.

Safeguarding Your Wealth: Investment Strategies Against Inflation

Protecting your savings from inflation requires proactive strategies. Simply holding cash is rarely the best option. Diversifying your investments is a powerful defense. Certain assets historically perform well during inflationary periods. These assets can help maintain your purchasing power. Consider real assets as an example. Real estate often appreciates with inflation. It also provides rental income that can increase. Commodities like gold, oil, and agricultural products can also serve as hedges. Their prices tend to rise when inflation heats up. Investing in these can protect your portfolio.

Stocks, particularly those of companies with pricing power, can also be beneficial. Companies that can pass higher costs to consumers thrive. They maintain their profit margins. This can include essential goods or strong brand companies. Treasury Inflation-Protected Securities (TIPS) are another direct tool. TIPS are government bonds designed to protect against inflation. Their principal value adjusts with the CPI. This ensures your investment keeps pace with rising prices. Diversification across these asset classes is key. It spreads risk and enhances potential returns.

Here are some investment avenues to consider:

- Real Estate: Property values and rental income may increase with inflation.

- Commodities: Gold and other raw materials often perform well. They act as a store of value.

- Stocks: Look for companies with strong pricing power. These firms can adapt to rising costs.

- Treasury Inflation-Protected Securities (TIPS): These bonds are indexed to inflation. They offer direct protection.

- Dividend Stocks: Companies paying regular dividends can offer increasing income streams. This helps combat inflation.

- Value Stocks: Companies trading below their intrinsic value may offer growth potential. This can outpace inflation.

Remember, no single investment is a perfect shield. A well-diversified portfolio is your best defense. It balances growth with stability. Regular review and adjustment of your portfolio are also vital. This ensures it aligns with current economic conditions.

Inflation’s Role in Retirement Planning and Long-Term Goals

Inflation significantly impacts long-term financial goals. Retirement planning is a prime example. Failing to account for inflation means underestimating future expenses. Your retirement fund might seem sufficient today. However, its purchasing power could be severely diminished later. This highlights the importance of realistic projections. Financial planners often use an inflation-adjusted return rate. This helps estimate how much money you truly need. It ensures your savings grow enough to support your desired lifestyle.

Consider healthcare costs, for instance. These expenses tend to rise faster than general inflation. Planning for retirement must include these specific increases. Your investment strategy should aim for real returns. Real return is your investment gain minus the inflation rate. A positive real return is crucial for growing your wealth. It means your money is actually increasing in value. For long-term goals like college savings or a down payment, the principle is similar. You need to ensure your savings outpace price increases. This secures your future purchasing power.

Strategies for long-term planning include:

- Aggressive Growth Early On: Younger investors can take more risk. This aims for higher returns to beat inflation.

- Diversified Portfolio: A mix of stocks, bonds, and real assets helps. It balances risk and return over time.

- Regular Contributions: Consistently investing money helps. It leverages dollar-cost averaging.

- Inflation-Adjusted Goals: Regularly review and adjust your financial goals. Ensure they account for future price increases.

- Professional Advice: Consult a financial advisor. They can help tailor a plan for your specific situation.

Understanding inflation’s long-term effects is critical. It empowers you to make smarter choices today. These choices will safeguard your financial future.

Beyond Savings: Broader Economic Implications of Inflation

Inflation extends its reach beyond personal savings. It influences the broader economy in several ways. High inflation can create economic instability. It makes future planning difficult for businesses. This uncertainty can deter investment. It slows down economic growth. Consumers may also lose confidence. They might reduce spending due to rising prices. This can further dampen economic activity. Conversely, very low inflation or deflation also poses risks. Deflation, falling prices, can lead to reduced spending. Consumers might delay purchases. They expect prices to fall further. This can trigger a recession.

Central banks play a vital role in managing inflation. They use monetary policy tools. Raising interest rates is a common method. Higher rates make borrowing more expensive. This slows down economic activity. It reduces demand, helping to curb inflation. Lowering rates stimulates the economy. This is often done during periods of low inflation or recession. The goal is to achieve price stability. This means keeping inflation at a healthy, manageable level. Typically, around 2% is considered ideal. This balance supports sustainable economic growth. It also preserves purchasing power.

Inflation affects different sectors and individuals unevenly. Those on fixed incomes are often hit hardest. Their income does not adjust with rising prices. Borrowers, however, might benefit. The real value of their debt decreases. Lenders, conversely, may lose out. Their loans are repaid with money worth less. Understanding these broader implications is vital. It provides a comprehensive view of inflation’s impact. It highlights the importance of sound economic policies. Both individuals and governments must consider these factors.

Conclusion

Inflation is a fundamental economic concept. It significantly influences your financial well-being. From everyday purchases to long-term savings, its effects are profound. Understanding “What Is Inflation and How It Impacts Your Savings” is not merely academic. It is a practical necessity for every informed individual. We explored how inflation erosional purchasing power. We also discussed how it silently diminishes your hard-earned money. Ignoring inflation can lead to a significant reduction in your future wealth. This is especially true for retirement funds and other long-term goals.

Fortunately, you are not powerless against this economic force. Strategic investment decisions can act as a strong defense. Diversifying your portfolio is a critical step. Including assets like real estate, certain stocks, and TIPS can help. These investments tend to perform better during inflationary periods. They can help preserve and even grow your wealth. Regular review of your financial plan is also essential. Adjusting your strategy as economic conditions change ensures continued protection. Empower yourself with knowledge and proactive planning. Take control of your financial future. Protect your savings from the silent erosion of inflation.